Work From Home 2025 Ato Deduction Rate. As rosemary has used the fixed rate method to claim her working from home expenses, she can't claim a separate deduction for the cost of using her mobile phone for. You may need to keep different records.

It is however dependant on age and effective life of the assets. As rosemary has used the fixed rate method to claim her working from home expenses, she can’t claim a separate deduction for the cost of using her mobile phone for.

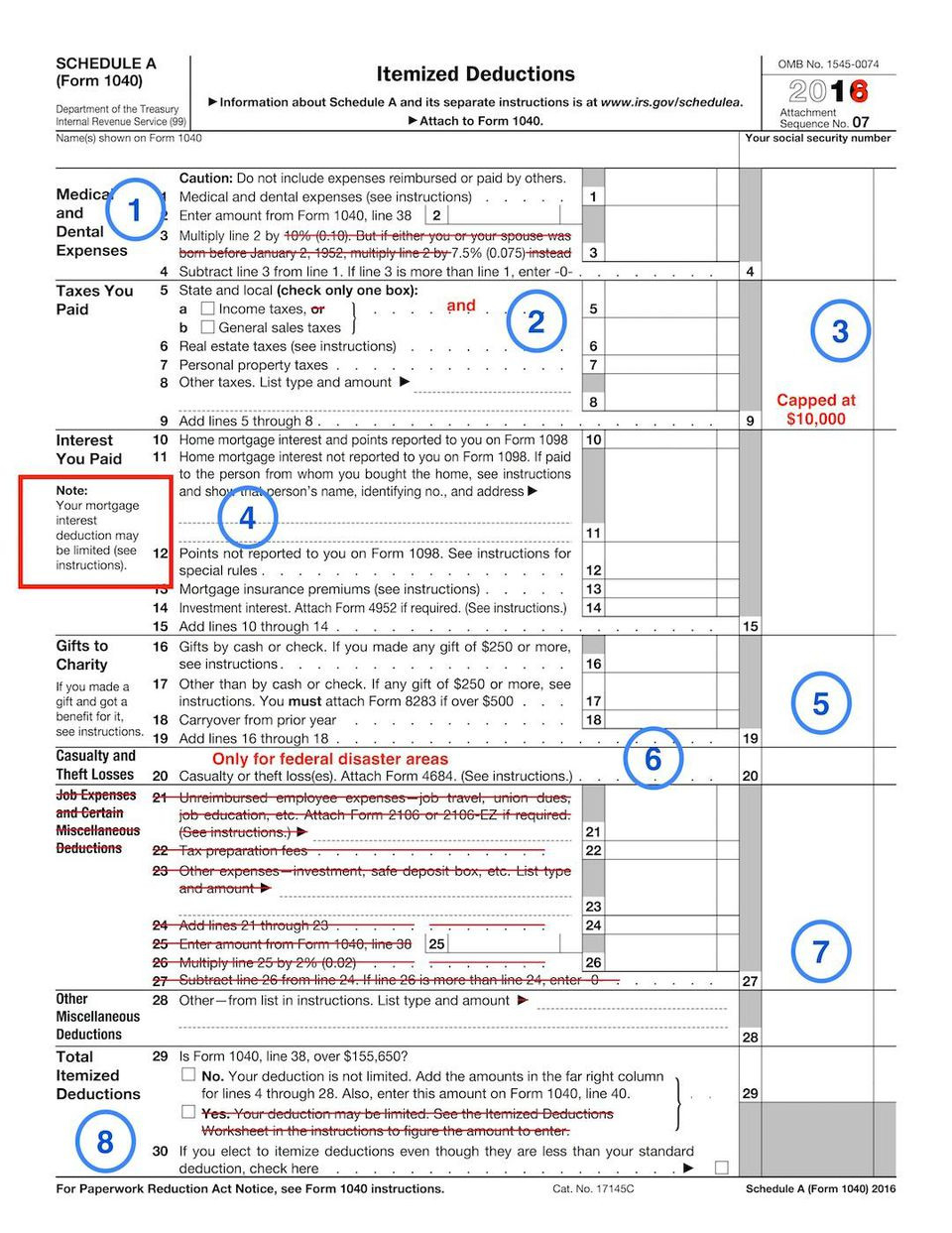

ATO Work From Home Deductions What You Need To Know, Australians who work from home and want to simplify their tax returns will soon need to record each hour they complete outside the office or worksite, thanks to a major update to how the australian taxation office (ato) calculates income.

2025 Tax Rates And Deductions Available Shel Yolane, Using the fixed rate method, they can claim a rate of 67 cents per hour worked at home.

Home Office & Work From Home Expenses SocietyOne, If you work from home, it’s important you read on as it will affect how the deduction is calculated on.

ATO Working from home COVID19 shortcut extended One Click Life, Howdy @ladydee, yes, you can claim for these.

ATO Announces Changes to Work From Home Deductions Jennifer Bicknell, To use the actual cost method to claim actual expenses, you must:

Ato Personal Tax Rates 2025 Dulci Glennie, You can claim 67 c for each hour you work from home during the relevant income year.

House Deductions 2025 Tiff Shandra, From 1 july 2025, the revised fixed rate method allows individuals to claim running expenses incurred as a result of working from home at 67 cents per hour (pcg 2025/1).

2025 Tax Rates And Standard Deduction U/S Vivie Tricia, Under this method, you can claim 67 cents per hour for.

FREE Working from Home ATO factsheet OBT Financial Group, Under this method, you can claim 67 cents per hour for.